beautiful-belly.site

Market

Chimerix Stock

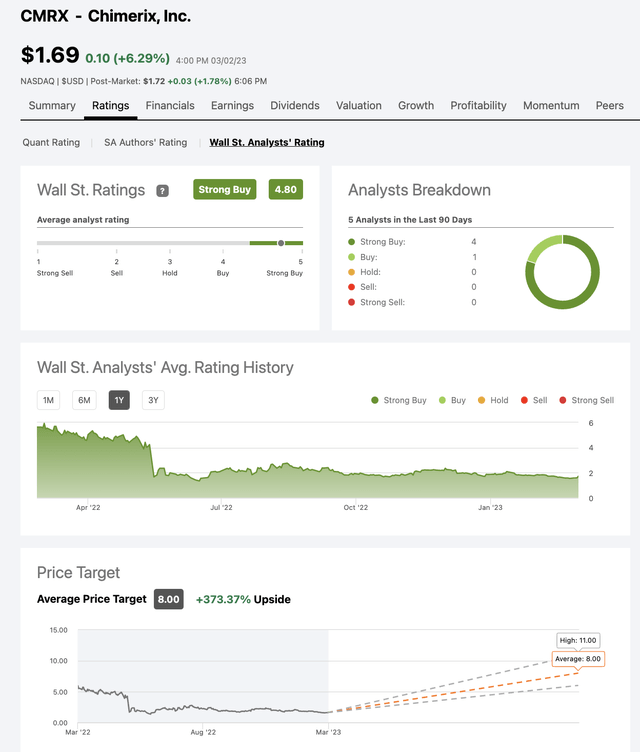

Chimerix's mission is to develop medicines that meaningfully improve and extend the lives of patients facing deadly diseases. Chimerix stock price, live market quote, shares value, historical data, intraday chart, earnings per share and news. The average price target is $ with a high forecast of $ and a low forecast of $ The average price target represents a % change from the last. Research Chimerix's (Nasdaq:CMRX) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more. Chimerix Stock (NASDAQ: CMRX) stock price, news, charts, stock research, profile. View the CMRX premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Chimerix Inc real time. The Chimerix ticker is CMRX and it is traded on the Nasdaq Global Market. Where is Chimerix's corporate headquarters? Meridian Parkway. View Chimerix, Inc. CMRX stock quote prices, financial information, real-time forecasts, and company news from CNN. Today's High; $ Today's Low; $ 52 Week High; $ 52 Week Low; $ STOCK CHART. Data Provided by Refinitiv. Minimum 15 minutes delayed. Chimerix's mission is to develop medicines that meaningfully improve and extend the lives of patients facing deadly diseases. Chimerix stock price, live market quote, shares value, historical data, intraday chart, earnings per share and news. The average price target is $ with a high forecast of $ and a low forecast of $ The average price target represents a % change from the last. Research Chimerix's (Nasdaq:CMRX) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more. Chimerix Stock (NASDAQ: CMRX) stock price, news, charts, stock research, profile. View the CMRX premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Chimerix Inc real time. The Chimerix ticker is CMRX and it is traded on the Nasdaq Global Market. Where is Chimerix's corporate headquarters? Meridian Parkway. View Chimerix, Inc. CMRX stock quote prices, financial information, real-time forecasts, and company news from CNN. Today's High; $ Today's Low; $ 52 Week High; $ 52 Week Low; $ STOCK CHART. Data Provided by Refinitiv. Minimum 15 minutes delayed.

Chimerix Announces Completion of Public Offering of Common Stock and Exercise in Full of Option to Purchase Additional Shares of Common Stock. Chimerix. Track Chimerix Inc (CMRX) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get valuable. A high-level overview of Chimerix, Inc. (CMRX) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and investment. Chimerix, Inc. (NASDAQ: CMRX) is a pioneering biopharmaceutical company focused on the development of innovative antiviral therapeutics. Chimerix Inc CMRX:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date03/08/24 · 52 Week Low · 52 Week. See the latest Chimerix Inc stock price (CMRX:XNAS), related news, valuation, dividends and more to help you make your investing decisions. View live Chimerix, Inc. chart to track its stock's price action. Find market predictions, CMRX financials and market news. This stock may move much during the day (volatility) and with a large prediction interval from the Bollinger Band this stock is considered to be "high risk". Stock analysis for Chimerix Inc (CMRX:NASDAQ GM) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Chimerix Inc. · AT CLOSE PM EDT 08/30/24 · USD · % · Volume, Chimerix (CMRX) Reports Q2 Loss, Misses Revenue Estimates. Chimerix (CMRX) delivered earnings and revenue surprises of 0% and %, respectively, for the. Chimerix Inc. ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A ; Dividend Yield, N/A. Discover real-time Chimerix, Inc. Common Stock (CMRX) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Looking to buy Chimerix Stock? View today's CMRX stock price, trade commission-free, and discuss CMRX stock updates with the investor community. Get the latest Chimerix Inc (CMRX) real-time quote, historical performance, charts, and other financial information to help you make more informed trading. CMRX - Chimerix, Inc. Stock - Stock Price, Institutional Ownership, Shareholders (NasdaqGM). The Wall Street analyst predicted that Chimerix's share price could reach $ by Aug 14, The average Chimerix stock price prediction forecasts a. Chimerix Inc stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Use this tool to obtain historical stock prices for Chimerix, Inc. On what stock exchange are Chimerix shares traded, and what is the ticker symbol? The Chimerix ticker is CMRX and it is traded on the Nasdaq Global Market.

How Do You Get An Llc In Florida

Florida LLC Formation Requirements · How to start an LLC in Florida · Decide on a name for your LLC · Determine management structure (member vs. manager). 6 Steps to Starting an LLC in Florida · Step 1: Name Your Florida LLC · Step 2: Appoint a Registered Agent · Step 3: File Your Articles of Organization · Step 4. Call the Florida Incorporation Service Toll Free: · Name your LLC and complete registration of this name with the Division of Corporations. Submit the form by mail, in person or online. The filing fee is $ Florida offers hour expedited processing for an additional $ Walk in filings are. Anonymous LLC in Florida Businesses seeking privacy cannot directly anonymously form an LLC in Florida. However, they can still acheive privacy with a double. Unlike other states, Florida only requires that LLCs provide a list of managers on the Articles of Organization. This means that Florida does not require the. Starting an LLC in Florida involves appointing a registered agent and filing the Articles of Organization. This guide provides a step-by-step process to get. Limited Liability Company. Form a limited liability company (LLC) in Florida. Complete and file the documentation online. How to Form an LLC in Florida · 1. Choose a Name for your Florida LLC · 2. File the Florida LLC Articles of Organization · 3. Appoint a Registered Agent · 4. Florida LLC Formation Requirements · How to start an LLC in Florida · Decide on a name for your LLC · Determine management structure (member vs. manager). 6 Steps to Starting an LLC in Florida · Step 1: Name Your Florida LLC · Step 2: Appoint a Registered Agent · Step 3: File Your Articles of Organization · Step 4. Call the Florida Incorporation Service Toll Free: · Name your LLC and complete registration of this name with the Division of Corporations. Submit the form by mail, in person or online. The filing fee is $ Florida offers hour expedited processing for an additional $ Walk in filings are. Anonymous LLC in Florida Businesses seeking privacy cannot directly anonymously form an LLC in Florida. However, they can still acheive privacy with a double. Unlike other states, Florida only requires that LLCs provide a list of managers on the Articles of Organization. This means that Florida does not require the. Starting an LLC in Florida involves appointing a registered agent and filing the Articles of Organization. This guide provides a step-by-step process to get. Limited Liability Company. Form a limited liability company (LLC) in Florida. Complete and file the documentation online. How to Form an LLC in Florida · 1. Choose a Name for your Florida LLC · 2. File the Florida LLC Articles of Organization · 3. Appoint a Registered Agent · 4.

Now more than , LLCs are formed in Florida annually. One or more persons may form an LLC. A single-member LLC is allowed in Florida. What are some of the. In summary, operating an LLC in Florida requires compliance with state regulations and the creation of an operating agreement. LLCs must file an annual report. ➢. The name of a limited liability company in the state of Florida must contain the words “Limited Liability Company,” The abbreviation “L.L.C.,” or the. If you choose to file online, the approval process typically takes 2 to 5 business days for the Florida Division of Corporations to process your LLC formation. New Florida Limited Liability Company Fees ; Articles of Organization, $ ; Registered Agent Designation, $ ; Certified Copy (optional), $ Quick Summary: · It takes business days to form an LLC in Florida if you apply by mail and business days if filed online. · The state of Florida does. Cost & Fees of Starting an LLC in Florida. The fee for forming a Florida LLC is $ You'll also need to pay $ every year to file the state's annual. What are the Steps to Starting an LLC in Florida? · Step 1: Name Your Florida LLC · Step 2: Designate a Registered Agent · Step 3: File Articles of Organization. How to form an LLC in Florida in 6 easy steps · 1) Check if your business name is available · 2) Claim your name · 3) Write your operating agreement · 4) File. The Basics of Maintaining Your LLC · Annual Report: Required filing in Florida to keep your LLC in good standing · Articles of Organization: Updating of your. To start an LLC in Florida, you'll need to file Articles of Organization with the Florida Division of Corporations and pay the $ state filing fee. You can. How to Start an LLC in Florida · 1. Choose a Name for Your Florida LLC · 2. Appoint a Registered Agent for Your Florida LLC · 3. File Articles of Organization. Although Florida does not require you to do so, you should also create an Operating Agreement to establish ownership terms and member roles for your LLC. This. Florida LLC Members: Florida LLCs require 1 or more members. There is no residence or age requirement. Florida LLC members are not required to be listed in the. ARTICLE I: The name of the limited liability company, which must contain the words “Limited Liability Company, “or the abbreviation. “L.L.C.,”. What are the LLC formation requirements in Florida? To form an LLC in Florida, you must: Although you do not have to file an operating agreement, creating one. Starting an LLC in Florida with Inc Authority is absolutely free of charge. You only have to pay the state registration fee and Inc Authority will handle. New Florida/Foreign LLC. Filing Fee (Required), $ Registered Agent Fee (Required), $ Total Fee For New Florida/Foreign LLC, $ Change of. 9 Steps to start an LLC in Florida · 9. File your annual reports · 8. Find out what other business licenses you need · 7. Open a bank account · 6. Create an. The treatment of a Limited Liability Company (LLC) under Florida reemployment law depends on how the LLC files its federal income tax return.

Can I Trade Crypto On Fidelity

Cryptocurrency accounts, custody and trading provided by Fidelity Digital Asset Services, LLC, a New Fidelity does not endorse or adopt their content. Neither FBS nor NFS offer crypto as a direct investment nor provide trading or custody services for such assets. Fidelity Crypto and Fidelity Digital Assets are. Buying Bitcoins through Fidelity is the same process as buying a portion of a property with Bitcoin. Tokenization is that you buy part of the. A new crypto exchange backed by firms including Citadel Securities, Fidelity Digital Assets and Charles Schwab Corp. said it's gone live, a move that could. By owning crypto like bitcoin or ethereum directly, you can trade your crypto through your Fidelity Crypto® account 7 days a week, 23 hours a day. You'll get. Fidelity Crypto is more than a platform; it represents the evolution of investment solutions. Boasting roots within Fidelity Investments – known for mutual. Fidelity Crypto® is offered by Fidelity Digital Assets℠. Investing involves risk, including risk of total loss. Crypto as an asset class is highly volatile, can. Investors using Fidelity's platform have the flexibility to combine various cryptocurrencies like Bitcoin and Ethereum with traditional investment products such. Fidelity launched its initial venture into the cryptocurrency markets in · Fidelity's products are geared towards institutional and accredited investors. Cryptocurrency accounts, custody and trading provided by Fidelity Digital Asset Services, LLC, a New Fidelity does not endorse or adopt their content. Neither FBS nor NFS offer crypto as a direct investment nor provide trading or custody services for such assets. Fidelity Crypto and Fidelity Digital Assets are. Buying Bitcoins through Fidelity is the same process as buying a portion of a property with Bitcoin. Tokenization is that you buy part of the. A new crypto exchange backed by firms including Citadel Securities, Fidelity Digital Assets and Charles Schwab Corp. said it's gone live, a move that could. By owning crypto like bitcoin or ethereum directly, you can trade your crypto through your Fidelity Crypto® account 7 days a week, 23 hours a day. You'll get. Fidelity Crypto is more than a platform; it represents the evolution of investment solutions. Boasting roots within Fidelity Investments – known for mutual. Fidelity Crypto® is offered by Fidelity Digital Assets℠. Investing involves risk, including risk of total loss. Crypto as an asset class is highly volatile, can. Investors using Fidelity's platform have the flexibility to combine various cryptocurrencies like Bitcoin and Ethereum with traditional investment products such. Fidelity launched its initial venture into the cryptocurrency markets in · Fidelity's products are geared towards institutional and accredited investors.

Fidelity Investments' retail customers could soon have the option to trade bitcoin directly through the brokerage platform. Since , Fidelity has operated. Fidelity Crypto is not a trusted broker because it is not regulated by a financial authority with strict standards. Fidelity Crypto gives you the opportunity to buy, sell, and secure bitcoin and ethereum with as little as $1 and access both your traditional. Yes. With Fidelity Crypto®, you can trade and secure crypto like bitcoin and ethereum directly with as little as $1. By owning crypto like bitcoin or ethereum. Yes. With Fidelity Crypto®, you can trade and secure crypto like bitcoin and ethereum directly with as little as $1. By owning crypto like bitcoin or ethereum. Brokerage to crypto transfer · 1. On the Transact screen, tap the Transfer icon · 2. Select the brokerage account linked to your Fidelity Crypto® account. 3. Neither FBS nor NFS offer crypto as a direct investment nor provide trading or custody services for such assets. Fidelity Crypto and Fidelity Digital Assets are. Fidelity began researching bitcoin and developing blockchain solutions in After seeing demand from its clients, Fidelity developed a dedicated business. The investment seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the Fidelity Crypto Industry. Fidelity Investments, the TradFi asset management goliath, plans to launch Ethereum trading and custody services for institutional clients beginning Oct. Fidelity Crypto® is offered by Fidelity Digital Assets℠. Investing involves risk, including risk of total loss. Crypto as an asset class is highly volatile. Fidelity Digital Assets is dedicated to building enterprise-grade custody and trading services for institutional investors. Learn more about our digital. To begin the process, log into your Fidelity account and navigate to the section where cryptocurrency trading is available. Look for the option to link your. Clients looking for spot bitcoin ETFs or spot ether ETFs can find these and other third-party ETF and mutual fund products available at Schwab. These funds. LJ from Fidelity Crypto here. There's no longer an early access list. Eligible users can start trading Litecoin by opening a Fidelity Crypto. Cryptocurrency stocks, ETFs, and coin trusts · Available in brokerage accounts and IRAs · No crypto wallet and storage required. Cryptocurrency stocks, ETFs, and coin trusts · Available in brokerage accounts and IRAs · No crypto wallet and storage required. With Fidelity Crypto®, you can trade and secure crypto like bitcoin and ethereum for as little as $1. You'll get institution-level security and services that. Fidelity Digital Assets currently offers bitcoin, ether and Litecoin custody and trading. do not apply to the cryptoasset activities carried on by FDA LTD. Fidelity Will Open Cryptocurrency Trading to Its 27 Million Customers On the heels of a massive 10% price jump in Bitcoin (BTC) [coin_price] and after a rocky.

Cashing Out Equity In Your Home

Both cash-out refinances and home equity loans come with pros and cons. On the plus side, you'll usually receive a lower interest rate when you apply for a. Cash-out refinancing allows you to convert your home equity into cash and take out a loan that is larger than your current mortgage. If your home is worth. You can use a cash-out refinance or home equity loan to access the cash in your home to renovate your property, pay for college expenses or consolidate debt. Many homeowners use cash-out refinances to get the funds they need for a down payment on a new property or buy a new home in cash if they have enough equity. If you have enough equity in your home, cash out refinancing can provide a low-cost source of funds to use for just about any purpose. Popular reasons to. Cash-Out Refinancing leverages your current equity using a second mortgage that is greater than the first. The borrower uses the new mortgage to pay off the. Cash-out refinancing, which replaces your current mortgage loan with a larger one and gives you the difference in cash. The more equity you have, the more cash. Cash-out refinancing is when you leverage your home's equity to borrow more money than is owed on your existing mortgage and receive the difference in cash. Are you looking to tap into the equity in your home to get some extra cash? A cash-out refinance may be the solution you're looking for. With a cash-out. Both cash-out refinances and home equity loans come with pros and cons. On the plus side, you'll usually receive a lower interest rate when you apply for a. Cash-out refinancing allows you to convert your home equity into cash and take out a loan that is larger than your current mortgage. If your home is worth. You can use a cash-out refinance or home equity loan to access the cash in your home to renovate your property, pay for college expenses or consolidate debt. Many homeowners use cash-out refinances to get the funds they need for a down payment on a new property or buy a new home in cash if they have enough equity. If you have enough equity in your home, cash out refinancing can provide a low-cost source of funds to use for just about any purpose. Popular reasons to. Cash-Out Refinancing leverages your current equity using a second mortgage that is greater than the first. The borrower uses the new mortgage to pay off the. Cash-out refinancing, which replaces your current mortgage loan with a larger one and gives you the difference in cash. The more equity you have, the more cash. Cash-out refinancing is when you leverage your home's equity to borrow more money than is owed on your existing mortgage and receive the difference in cash. Are you looking to tap into the equity in your home to get some extra cash? A cash-out refinance may be the solution you're looking for. With a cash-out.

The difference is that a cash out refinance transforms your first mortgage into a new mortgage, whereas a home equity loan is a second mortgage, separate from. A cash-out refinance involves using the equity built up in your home to replace your current home loan with a new mortgage and when the new loan closes, you. A cash-out refinance takes the equity you have built up in your home, replaces your current home loan with a new mortgage, and when you close on the loan, you. The equity in your home: For cash-out refinancing, most lenders will usually allow you to borrow up to 80% of the value of your home. As such, the cash amount. A cash-out refinance allows you to replace your current mortgage and access a lump sum of cash at the same time. Any home loan that has the funds released to you directly is considered cash out by the banks. You can cash out your equity in a home by refinancing your. A cash out refinance lets you borrow money from your home's equity. With a cash out refinance, you replace your current mortgage with a new mortgage for a. Borrowing against the equity, whether through a loan or line of credit, can be less expensive than other forms of personal credit. A cash-out refinance, on the. A cash-out refinance allows you to get cash out of your home using your home's equity. You can use this cash to make repairs or remodel your home. A home equity loan is a financing option where you borrow against the value built up in your home. In most cases, you can only borrow up to roughly 80% of the. You'll get your funds the fastest when using a home equity line of credit (HELOC), but a home equity loan typically won't take much longer. A cash-out refinance. Much like if you're simply refinancing your mortgage for a lower interest rate, there will be closing costs associated with a cash-out refinance, which on. However, you can tap into your home equity without having to move. A cash-out refinance replaces your old mortgage with a new, larger loan. You pocket the. A cash-out refi provides you with a lump sum of cash and the predictability of fixed interest rates. In contrast, a home equity line of credit experiences. Cash-out refinancing is a type of mortgage refinancing that allows you to convert your home equity into cash. It replaces your existing home mortgage with a. Any home loan that has the funds released to you directly is considered cash out by the banks. You can cash out your equity in a home by refinancing your. A cash-out refinance replaces your existing mortgage with a loan for more than what you currently owe, letting you cash-out a portion of the equity that you've. Cash-out refinances allow homeowners to tap into their home equity to pay for medical expenses, home improvements, debt consolidation and other big purchases. A cash-out refinance can allow you to borrow from the equity you've built in your home and receive cash that can be used for just about anything.

Are Consolidation Loans Bad For Credit

While there's a definite upside to the ease of a single payment and the temptation of a lower interest rate, consolidation can hurt your credit score in a few. There are primarily three places you can get a debt consolidation loan with bad credit: Banks, credit unions, or online lenders. Visit your local bank or credit. A debt consolidation loan is a personal loan intended to pay off all of your debts at once. A debt consolidation loan is. Debt consolidation helps you avoid potential damage to your credit score. Timely and consistent payments on your consolidated loan contribute positively to your. Personal loans are one of the best types of loans for debt consolidation. Good credit and bad credit borrowers can qualify for personal loans that can be used. Debt consolidation loans just show up as a loan, not the purpose for the loan. Bank/credit union loans will be slightly better for your score. A Debt Consolidation Program (DCP) is an arrangement where you work one-on-one with a certified Credit Counsellor from a not-for-profit credit counselling. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come. Traditionally, debt consolidation loans require at least average credit, with a score above You may be able to score a personal loan with poor credit, but. While there's a definite upside to the ease of a single payment and the temptation of a lower interest rate, consolidation can hurt your credit score in a few. There are primarily three places you can get a debt consolidation loan with bad credit: Banks, credit unions, or online lenders. Visit your local bank or credit. A debt consolidation loan is a personal loan intended to pay off all of your debts at once. A debt consolidation loan is. Debt consolidation helps you avoid potential damage to your credit score. Timely and consistent payments on your consolidated loan contribute positively to your. Personal loans are one of the best types of loans for debt consolidation. Good credit and bad credit borrowers can qualify for personal loans that can be used. Debt consolidation loans just show up as a loan, not the purpose for the loan. Bank/credit union loans will be slightly better for your score. A Debt Consolidation Program (DCP) is an arrangement where you work one-on-one with a certified Credit Counsellor from a not-for-profit credit counselling. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come. Traditionally, debt consolidation loans require at least average credit, with a score above You may be able to score a personal loan with poor credit, but.

If your debt is less than 40% of your gross income and your credit is good enough to get you a 0% balance transfer or low-interest debt consolidation loan. Consolidating your current loans could cause you to lose credit for payments made toward IDR plan forgiveness or PSLF. Was this page helpful? Yes No. Tell us. If your credit score is poor and you've taken out a debt consolidation loan, it's really important to keep up with the repayments. You could risk damaging your. Do you have high-interest, unsecured debt from credit cards and personal loans following you around? Consider combining into a single, low-rate debt. While debt consolidation carries risks much like any other loan, it also has attractive advantages. LOWER INTEREST RATE. Consolidation loans tend to have lower interest rates than credit cards, so you will pay less interest over the life of your loan. · LOW. Ideally, consolidating your debt will help you secure better loan terms and interest rate, but it's not guaranteed–especially for applicants with less-than-. The best debt consolidation loans for bad credit are from LendingPoint. The company requires a credit score of to qualify, offers loan amounts of $1, -. Taking out a debt consolidation loan or a line of credit requires a hard credit pull, which will lower your credit score by 5 to 10 points. If your score is. If your debts are $10, or more, consolidation could help, but only if you have a consistent income to help you pay it back. Learn More About When to. For one, when you take out a new loan, your credit score could suffer a minor hit, which could affect whether you qualify for other new loans. Depending on how. Looking for the best debt consolidation loans for bad credit? Read our comparison of top lenders to find the best option to help you consolidate your debt. Compare debt consolidation loan rates from top lenders for August Debt Consolidation Loan Alternatives · Home Equity Line of Credit. Commonly known by the acronym HELOC, home equity lines of credit essentially allow you to use. You take out a low-interest rate installment loan, typically with a term of months. Then you use the funds to pay off your credit card balances and other. A debt consolidation loan combines multiple high-interest debts into one loan, which is repaid at a lower interest rate. Debt consolidation is the process of using a personal loan to pay off multiple lines of credit debt and/or other debts. Debt consolidation could be a good idea. Paying off multiple debts through consolidation could improve your credit utilization ratio (the amount of debt you have relative to your available credit). What is debt consolidation? · It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help. A debt consolidation loan is a form of debt refinancing that combines multiple balances from credit cards and other high-interest loans into a single loan.

Partner With Non Profit Organization

Help your nonprofit lay the foundation for their technology needs · Please sign in with your Microsoft AI Cloud Partner Program account · Connect with Customers. It is a church, charity, or benevolent organization. However, for Washington state tax purposes, all such organizations are taxed in the same manner as for-. The Nonprofit Partnership (NPP) exists to enhance the capacity and effectiveness of our nonprofit members through a variety of educational opportunities and. Developing strategic partnerships can be a powerful way for non-profit organizations to drive growth and achieve their goals. Help your nonprofit collaborate more effectively with smart, secure business Attract donors, raise awareness for your organization, and recruit volunteers. Pro Bono Partnership provides free business and transactional legal services to nonprofit organizations serving the disadvantaged or enhancing the quality. Rather than offering a discount can you treat it like an affiliate or partnership deal? Keep your rates the same, let them to the marketing and. Help your nonprofit lay the foundation for their technology needs · Please sign in with your Microsoft AI Cloud Partner Program account · Connect with Customers. Enjoy a variety of individual and organizational benefits with this complimentary membership. The Non-Profit Partner membership is offered to non-profit. Help your nonprofit lay the foundation for their technology needs · Please sign in with your Microsoft AI Cloud Partner Program account · Connect with Customers. It is a church, charity, or benevolent organization. However, for Washington state tax purposes, all such organizations are taxed in the same manner as for-. The Nonprofit Partnership (NPP) exists to enhance the capacity and effectiveness of our nonprofit members through a variety of educational opportunities and. Developing strategic partnerships can be a powerful way for non-profit organizations to drive growth and achieve their goals. Help your nonprofit collaborate more effectively with smart, secure business Attract donors, raise awareness for your organization, and recruit volunteers. Pro Bono Partnership provides free business and transactional legal services to nonprofit organizations serving the disadvantaged or enhancing the quality. Rather than offering a discount can you treat it like an affiliate or partnership deal? Keep your rates the same, let them to the marketing and. Help your nonprofit lay the foundation for their technology needs · Please sign in with your Microsoft AI Cloud Partner Program account · Connect with Customers. Enjoy a variety of individual and organizational benefits with this complimentary membership. The Non-Profit Partner membership is offered to non-profit.

Nonprofit Westchester is the county's only membership organization solely dedicated to strengthening Westchester's nonprofit organizations as they transform. We are also a powerful voice for the nonprofit sector in matters of policy and advocacy. Nonprofit organizations are invaluable to our state's social and. Partner with Us. We partner with America's nonprofits to engage the people they serve in voting and elections. Since , Nonprofit VOTE has provided. The Partnership for Public Service is a nonprofit, nonpartisan organization that is building a better government and a stronger democracy. · Explore Our Latest. Importance of Community Partnerships for Nonprofits. Community partnerships benefit both partners and strengthen the broader community. They also have the. Characteristics of a strong nonprofit board-staff partnership are mutual trust and respect, candor, and communication in and between board meetings. AWS Nonprofit Competency Partners provide innovative technology offerings that accelerate retailers' modernization and innovation journey across all areas. You can choose from various modern partnership opportunities like educational articles, webinars, and guides to contribute to the #1 Nonprofit Toolbox for. Whether or not your for-profit business can own a nonprofit organization is a common question. The short answer is, no - not technically. REQUIREMENTS OF THE NONPROFIT PARTNERSHIP PROGRAM. To be considered for the Nonprofit Partner Program, all organizations must: Applications for the Los. Whether or not your for-profit business can own a nonprofit organization is a common question. The short answer is, no - not technically. A Nonprofit Partner is an established nonprofit organization with a (c)(3) tax status. They may include organizational leaders such as board members. Forming a limited partnership between your business and a nonprofit organization could be a great idea. Combining your business resources and abilities with. Enjoy a variety of individual and organizational benefits with this complimentary membership. The Non-Profit Partner membership is offered to non-profit. Donate labor. Along with financial or material donations, donation of labor is a valuable resource for many non-profits—and, if you run a small business with at. Five Examples of Nonprofit Collaboration to Enhance Public Engagement and Fundraising Results · 1. Collaborative Arts Festivals · 2. Museum Consortiums · 3. Partnership Stories · Washington State Department of Commerce (Commerce): Unfamiliar Territory Leads to a Model for Successful Government/Nonprofit Partnership. Discover the free LinkedIn resources and support available to nonprofit organizations working to create economic opportunity In partnership with. You create opportunities for your employees to improve the communities where they live and work. And you connect your brand to a trusted nonprofit that's. Widen Your Network— Attract New Business Partners and Relationships. Non-profits are generally very well connected, as they work with powerful and wealthy.

Annuity Scheme

Annuity from National Pension System. What Are Pension Plans? Pension plans are long-term savings schemes designed to build a financial cushion for retirement. Gold Monetisation Scheme. BORROW Loans, EMI. Your Loans · Popular Loans · Personal Convenient annuity payout modes - monthly, quarterly, semi-annually. An annuity plan is an insurance contract between you (the annuitant) and an insurance company to provide you with a regular stream of % guaranteed pension. With PNB MetLife's Immediate Annuity Plan, customize your retirement plan the way you want & get guaranteed income for the rest of your life. With PNB MetLife. TIAA Traditional Annuities have two phases. Learn more about how TIAA traditional annuities can work for your retirement. Plan your future financial goals with ease and precision with SBI Annuity Deposit Scheme Calculator. Get accurate & instant calculations of your annuity. An annuity is a contract between you and an insurance company that requires the insurer to make payments to you, either immediately or in the future. Annuity Plan Features · The minimum amount of your corpus that you have to invest in an annuity scheme is 40%. · You need to wait till you are 60 years old before. An annuity requires the issuer to pay out a fixed or variable income stream to the purchaser, beginning either at once or at some time in the future. People. Annuity from National Pension System. What Are Pension Plans? Pension plans are long-term savings schemes designed to build a financial cushion for retirement. Gold Monetisation Scheme. BORROW Loans, EMI. Your Loans · Popular Loans · Personal Convenient annuity payout modes - monthly, quarterly, semi-annually. An annuity plan is an insurance contract between you (the annuitant) and an insurance company to provide you with a regular stream of % guaranteed pension. With PNB MetLife's Immediate Annuity Plan, customize your retirement plan the way you want & get guaranteed income for the rest of your life. With PNB MetLife. TIAA Traditional Annuities have two phases. Learn more about how TIAA traditional annuities can work for your retirement. Plan your future financial goals with ease and precision with SBI Annuity Deposit Scheme Calculator. Get accurate & instant calculations of your annuity. An annuity is a contract between you and an insurance company that requires the insurer to make payments to you, either immediately or in the future. Annuity Plan Features · The minimum amount of your corpus that you have to invest in an annuity scheme is 40%. · You need to wait till you are 60 years old before. An annuity requires the issuer to pay out a fixed or variable income stream to the purchaser, beginning either at once or at some time in the future. People.

Annuity plans, also known as retirement plans, enable one to receive payments regularly after paying a lump sum amount. That payment made is further used by the. Annuity Deposit Scheme - Check Eligibility Criteria and Interest Rates of SBI Annuity Deposit Scheme. The annuity scheme in NPS regulated by the PFRDA lets you do just that. Depending on the scheme, it is an investment avenue offering regular dividends for life. An annuity is a financial contract between an individual and an insurance company in which the individual makes a lump-sum payment or a. SBI Annuity Deposit Scheme - Annuity Deposit scheme allows customer to make a one-time deposit and get a monthly payment. Learn about the features. Gold Monetisation Scheme. BORROW Loans, EMI. Your Loans · Popular Loans · Personal Convenient annuity payout modes - monthly, quarterly, semi-annually. Achieve a stress-free retirement with the regular guaranteed income provided by SBI Life- Smart Annuity Plus. This is an annuity plan that offers both immediate. In investment, an annuity is a series of payments made at equal intervals. Examples of annuities are regular deposits to a savings account, monthly home. Annuity plans are retirement plans that enable you to receive a regular income during your retirement years after you invest in the plan over the years or. Annuity Payout. Annuity Payout. Starting Principal. Return Rate. %. Years to Pay Out. Calculate. Annual Payout Amount. Disclaimer: Please note that these. An annuity plan is a financial product that provides you guaranteed regular payments for the rest of your life after making a lump sum investment. The life. Pension plans are long-term savings schemes designed to build a financial cushion for retirement. Annuity refers to the regular income or monthly payment. Annuity payout rate, as annuity rate, is calculated as follows Web Accessibility Recognition Scheme CPAS. A wholly-owned subsidiary of The. An annuity plan is a type of financial product that provides a stream of income to an individual over a specified period of time, typically in retirement. Annuity scheme of the respective Annuity Service Provider). 4. Which Annuity Schemes are available? Following schemes are available with ASPs: Annuity for. Annuity Service Providers (ASPs) are be appointed by PFRDA to maintain the annuity contribution of subscribers through their various schemes. After choosing an annuity scheme, you can withdraw a monthly pension. How does NPS annuity plan work? NPS matures when you turn After that, you can redeem. Scheme. Take up to 25% of your DC pension pot tax-free before you buy an annuity. When you retire and just before you buy your annuity, you have the option. Benefits of investing in a Group Annuity Plan · It's a defined benefit plan which offers to pay assured regular pay-outs to your employees after their. Buy the Best Annuity Plan online with Kotak Life & Get Rs per month* starting next month. Earn income without having financial worries post retirement.

Vertical Put Spread

:max_bytes(150000):strip_icc()/dotdash_Final_Which_Vertical_Option_Spread_Should_You_Use_Sep_2020-03-34c346d142194e909757661f6cdcd95a.jpg)

In a vertical spread, a trader takes two trades simultaneously – buying one option and selling another of a different strike but the same underlying asset and. There are four possible vertical spreads: bull call spread, bear put spread, bear call spread, and bull put spread. This page explains what they have in common. A bear put spread is a type of vertical spread. It consists of buying one put in hopes of profiting from a decline in the underlying stock. Bull Put Credit Spreads Screener helps find the best bull put spreads with a high theoretical return. A bull put spread is a credit spread created by. A Double Bull Spread consists of 4 options on 4 different strikes for the same expiration. In simple terms, you are trading 2 vertical bullish spreads in the. Vertical put spreads have the same expiration date but different strike prices. They can be used as part of a bullish (the price of an asset is increasing) or. Vertical Put Spreads. A strategy consisting of the purchase of a put option with one expiration date and strike price and the simultaneous sale of another. The four vertical spread options strategies are the Bull Call Spread, Bull Put Spread, Bear Call Spread, and Bear Put Spread. In this video. Long Put Vertical Summary · A long put vertical spread is a bearish position involving a long and short put with different strike prices in the same expiration. In a vertical spread, a trader takes two trades simultaneously – buying one option and selling another of a different strike but the same underlying asset and. There are four possible vertical spreads: bull call spread, bear put spread, bear call spread, and bull put spread. This page explains what they have in common. A bear put spread is a type of vertical spread. It consists of buying one put in hopes of profiting from a decline in the underlying stock. Bull Put Credit Spreads Screener helps find the best bull put spreads with a high theoretical return. A bull put spread is a credit spread created by. A Double Bull Spread consists of 4 options on 4 different strikes for the same expiration. In simple terms, you are trading 2 vertical bullish spreads in the. Vertical put spreads have the same expiration date but different strike prices. They can be used as part of a bullish (the price of an asset is increasing) or. Vertical Put Spreads. A strategy consisting of the purchase of a put option with one expiration date and strike price and the simultaneous sale of another. The four vertical spread options strategies are the Bull Call Spread, Bull Put Spread, Bear Call Spread, and Bear Put Spread. In this video. Long Put Vertical Summary · A long put vertical spread is a bearish position involving a long and short put with different strike prices in the same expiration.

Bear Put Spread: Vertical Spreads. ABC PRICE @. EXPIRATION. VALUE OF. LONG 50 PUT. VALUE OF. SHORT 45 PUT. VALUE OF 50/ PUT SPREAD. $ $7. ($2). $5. $ A vertical debit spread is a defined risk, directional options trading strategy where we buy an option that we want to increase in value. Vertical spreads, or money spreads, are spreads involving options of the same underlying security, same expiration month, but at different strike prices. The vertical credit spread is a commonly used strategy with option traders who expect prices to stall or even fall over the lifetime of the option contract. A short put vertical spread is a bullish position involving a short and long put with different strike prices in the same expiration. a put ratio vertical spread is selling 2 out-of-the-money put option contracts and buying 1 in-the-money put option contract. This bearish vertical spread is sometimes more broadly categorized as a "vertical spread": a family of spreads involving options of the same stock and same. A 1x2 ratio vertical spread with puts is created by buying one higher-strike put and selling two lower-strike puts. The investor sold the short put for $5 and bought the long put for $11, creating a net debit (purchase) of $6, or $ overall ($6 x shares). This step. Vertical Put spreads are bullish strategies where you profit from falling stock prices. Vertical Call spreads, on the other hand, are bearish plays where you. I use Option Alpha to manage vertical credit spreads. The platform can scan your positions every minute then liquidate when a profit target is hit. A vertical spread is an options trading strategy that involves the simultaneous buying and selling of two options of the same underlying asset and expiration. Vertical spreads are options strategies that involve opening long (buying) and short (selling) positions simultaneously, with the same underlying asset and. Selling vertical spreads: A refresher. The term “short vertical spread” can be a mouthful, but it simply means you're selling a put or call option for a credit. The investor sold the short put for $5 and bought the long put for $11, creating a net debit (purchase) of $6, or $ overall ($6 x shares). This step. A short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two different strike. You receive a premium for selling the higher strike put and have the right to sell the stock at the lower strike price to limit potential losses if the stock. vertical spreads to profit from their expectations. Bullish traders may use bull call spreads, while bearish traders may employ bear put spreads. Income. A vertical spread strategy in option trading involves simultaneously buying and selling a call or put option of the same underlying asset with different strike. A vertical spread is a popular strategy in options trading that allows traders to manage risk and enhance profitability.

Progressive Towing Company

Save on tow truck insurance from Progressive. Learn about commercial tow truck insurance coverages and get a quote today. Progressive Insurance Company introduced a new version of its Personal Auto ROADSIDE ASSISTANCE (TOWING/LABOR) COVERAGE: PROGRESSIVE: Limit of. Auto roadside assistance. Progressive's Roadside Assistance pays for towing services, lock-out service, flat tire changes, fuel/fluid delivery if you run out. ACTIVE: The entity's US DOT number is active. INACTIVE: Inactive per 49 CFR (b)(4); biennial update of MCS data not completed. OUT-OF-SERVICE: Carrier. With Progressive, it's easy to get and manage affordable car insurance. We've been focused on exceptional customer service and coverage for 85+ years. A: You can start a claim by calling the Progressive roadside service number at or by using the Progressive app. Q: How does Progressive towing. Towing: Whenever your covered vehicle requires more than at-the-scene service, we can arrange to tow it anywhere within a mile radius, or to the nearest. Roadside Assistance is available 24/7 – just call at any time, and a representative will dispatch a roadside service professional to help you. You can get support online or call us at 24/7 Roadside Assistance for commercial vehicles. Progressive's 24/7 Roadside Assistance is an extra. Save on tow truck insurance from Progressive. Learn about commercial tow truck insurance coverages and get a quote today. Progressive Insurance Company introduced a new version of its Personal Auto ROADSIDE ASSISTANCE (TOWING/LABOR) COVERAGE: PROGRESSIVE: Limit of. Auto roadside assistance. Progressive's Roadside Assistance pays for towing services, lock-out service, flat tire changes, fuel/fluid delivery if you run out. ACTIVE: The entity's US DOT number is active. INACTIVE: Inactive per 49 CFR (b)(4); biennial update of MCS data not completed. OUT-OF-SERVICE: Carrier. With Progressive, it's easy to get and manage affordable car insurance. We've been focused on exceptional customer service and coverage for 85+ years. A: You can start a claim by calling the Progressive roadside service number at or by using the Progressive app. Q: How does Progressive towing. Towing: Whenever your covered vehicle requires more than at-the-scene service, we can arrange to tow it anywhere within a mile radius, or to the nearest. Roadside Assistance is available 24/7 – just call at any time, and a representative will dispatch a roadside service professional to help you. You can get support online or call us at 24/7 Roadside Assistance for commercial vehicles. Progressive's 24/7 Roadside Assistance is an extra.

We've combined technology with a compassionate human touch and an expansive network of drivers to deliver the best possible roadside assistance. Remain at the scene. Don't admit fault. · Find a safe location, call the police, and exchange driver information. · Call Progressive right away at The official answer is, as long as you are either ON an actual road, regardless of its surface, or the tow truck can safely hook up to you. In addition to roadside assistance service for cars, Progressive offers roadside assistance for motorcycles, boats and recreational vehicles. The same coverage. I'm dealing with Progressive's road side assistance now for the first time and it has not been great, I do not recommend. Impossible to get through to someone. Progressive. Progressive partners with a company called Agero to provide roadside assistance. These services can be used for your car, boat, motorcycle or RV. Safe Auto's roadside assistance coverage pays for towing services and certain repair costs required to make your car operable. Additional Discounts, Progressive. Terrible customer service. Sat on side of road in 95 degrees for over an hour. Had to call my own tow truck and then turn it in for reimbursement. Progressive Tow Insurance Protect your tow truck and yourself with a Progressive Tow Policy. Whether you are rescuing stranded vehicles, providing roadside. Reach out to Roadside Assistance number through They will request your towing services receipts to be sent via email or fax. Policyholder's name. Progressive roadside assistance covers services including towing, emergency roadside maintenance, and fuel delivery if your vehicle breaks down. Progressive's Roadside Assistance services are provided by Agero, which is trusted by drivers nationwide. Please call for roadside assistance. A leading auto insurance company, trusted since · SAVINGS. Over $ *Read the associated disclosure for this savings claim. Average annual savings for. With this addition to your insurance policy, your vehicle will be towed if it breaks down to the nearest qualified service center. That means if you have a. I logged in and pressed the 'roadside assistance button' · GPS pinpointed the exact address I was at and I confirmed. · I picked from a dropdown what service I. With Progressive's roadside assistance, if your vehicle breaks down, you can get it towed to the nearest qualified repair shop. The service covers towing within. Does roadside assistance cover locked keys in the car? · Get a quote · Or, call We have Progressive and their roadside assistance is provided through Coach Net as I recall. Check with your agent. We used it once with no problems. Urban Insurance has been selling Tow Truck policies for over 56 years. We know what you need, and will find you the lowest rates on Tow Truck Coverage. We have Progressive and their roadside assistance is provided through Coach Net as I recall. Check with your agent. We used it once with no problems.

People That Give Money

Some millionaires are philanthropists who by definition contribute money to non-profits directly or through a foundation. x your impact by finding and donating to the best charities. Learn about high-impact philanthropy, join an effective giving community, take a giving. Six out of ten US households donate to charity in a given year, and the typical household's annual gifts add up to between two and three thousand dollars. Donors. People like you give to your favorite projects; you feel great when you get updates about how your money is put to work by trusted organizations. Donors. GiveDirectly allows donors to send money directly to people in poverty with no strings attached. Our approach is guided by rigorous evidence of impact and. It's not like they're saving more on taxes than what they donated, so it's still costing them money to donate. However, there are some strategies that make the. A philanthropist is a person who gives money or gifts to charities, or helps needy people in other ways. Famous examples include Andrew Carnegie and Bill &. We partner with food banks, food pantries, and local food programs to bring food to people facing hunger. Give Stocks and Funds · Give by Mail or Phone · Give. Americans are much more willing than other peoples to voluntarily donate money to help the poor and stricken in foreign lands. The figures here depict private. Some millionaires are philanthropists who by definition contribute money to non-profits directly or through a foundation. x your impact by finding and donating to the best charities. Learn about high-impact philanthropy, join an effective giving community, take a giving. Six out of ten US households donate to charity in a given year, and the typical household's annual gifts add up to between two and three thousand dollars. Donors. People like you give to your favorite projects; you feel great when you get updates about how your money is put to work by trusted organizations. Donors. GiveDirectly allows donors to send money directly to people in poverty with no strings attached. Our approach is guided by rigorous evidence of impact and. It's not like they're saving more on taxes than what they donated, so it's still costing them money to donate. However, there are some strategies that make the. A philanthropist is a person who gives money or gifts to charities, or helps needy people in other ways. Famous examples include Andrew Carnegie and Bill &. We partner with food banks, food pantries, and local food programs to bring food to people facing hunger. Give Stocks and Funds · Give by Mail or Phone · Give. Americans are much more willing than other peoples to voluntarily donate money to help the poor and stricken in foreign lands. The figures here depict private.

We don't turn away people who need assistance; we are committed to bringing help and hope to all those in need. All of this is possible because of individuals. Contrary to popular belief, giving money to homeless people is okay. Yes, the official stance of the homeless services sector is: don't give money to. Relend money you get back to help another person. Just $25 can help many give with confidence. Three charity ratings from Charity Navigator, Great. To send money to an incarcerated person first: Look up their CDCR number using California Incarcerated Records and Information Search. Determine where th. Most people volunteer through a nonprofit organization (61%), but others volunteer through helping someone directly (29%), a religious organization (24%), civic. A philanthropist is a person who donates time, money, experience, skills or talent to help create a better world. The value of an in-kind contribution—the usual and normal charge—counts against the contribution limit as a gift of money does. A person may contribute. How we give? · 62% of people who gave money in did so via donation or sponsorship. · Cash giving was much lower than usual during the whole of , and the. — Learn more to the organizations we recommend. hands giving money graphic people do as much good as possible with their donations. We recommend a. Earning to give involves deliberately pursuing a high-earning career for the purpose of donating a significant portion of earned income, typically because. 4. Ted Turner. CNN founder, Ted Turner has been giving away his money for decades. In , Turner pledged $1 billion to UN. The Giving Pledge is a charitable campaign, founded by Bill Gates and Warren Buffett, to encourage wealthy people to contribute a majority (i.e. more than. About Give People Money A brilliantly reported, global look at universal basic income—a stipend given to every citizen—and why it might be necessary in an age. Philanthropy is charitable giving by individuals and organizations to worthy causes and includes donating money, time, and other forms of altruism. giving with an % increase in online donations. By the end of last year, billion people worldwide donated money to nonprofit organizations. 64% of. For example, an individual who has already contributed up to the limit to the campaign may not give money to another person to make a contribution to the same. Give Money. Help Feed Our Hungry Neighbors. Right now, one in seven people in Louisiana do not have enough to eat. Your gift today will help provide food and. Ways to Donate Money · Donate Online · Make a Monthly Gift · Mail, Text or Your financial gift helps people affected by disasters big and small. Give. What inspired your donation? “I just look at the economy and people struggling to put food on the table, and that's why I donate. “I wanted to give money to. Donated money to a charity? Volunteered your time to an organisation? This report includes the results of around million individuals interviewed across the.

1 2 3 4 5 6